The FX AlgoTrader Multi-Currency Range Analyzer is based on ATR data (ATR represents the AverageTrue Range for a currency pair.

Definition of 'Average True Range - ATR'

ATR is a measurement of volatility. It was introduced by Welles Wilder in his book: 'New Concepts in Technical Trading Systems'.

The 'true range' is the greatest of the following:

Current high less the current low |

Absolute value of the current high less the previous close |

Absolute value of the current low less the previous close |

The average true range is a moving average (generally 14 day) of the true ranges.

Welles Wilder originally developed the ATR for commodities but the indicator can also be used for stocks, indices and FX.

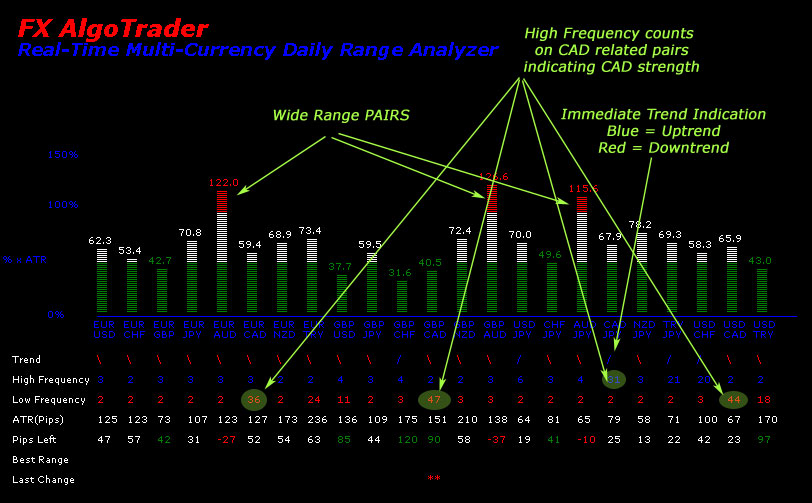

The FX AlgoTrader Multi-Currency Rangle Analyzer allows a trader to see market volatility at a macro level and consequently select the optimum pairs to focus attention on for trade selection.

Key Features:-

*** Get a free product data sheet for the Range Analyzer ***

The FX AlgoTrader Range Analyzer provides automated breakout and range analysis on over 20 forex pairs in real time.

The range analyzer calculates the current daily achieved range for each analysed pair and displays the data using a histogram.

This allows traders to make easy side by side comparisons on which pairs are most active in the market. The range analysis is based on ATR (Average True Range) data using a 14 day moving average.

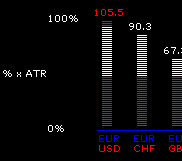

EURUSD and EURCHF ATR Histograms with EURUSD showing ATR at 105.5%

The Range Analyzer provides forex traders with frequency counts as new highs and lows form in real time. This provides highly indicative forex trend data essential for intraday fx pair selection.

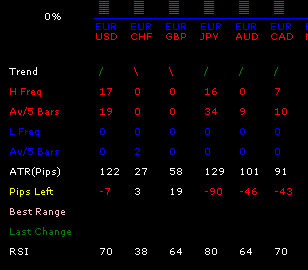

Analytical Data showing frequencies of new highs and lows and number of pips left before full ATR is reached.

The forex pairs are grouped logically which allows a speedy assessement of the relative currency strengths across the major forex pairs.

The FX AlgoTrader Real-Time Multi-Currency Daily Range Analyzer provides a unique multi-currency daily range overview for 24 forex currency pairs on a single chart pane.

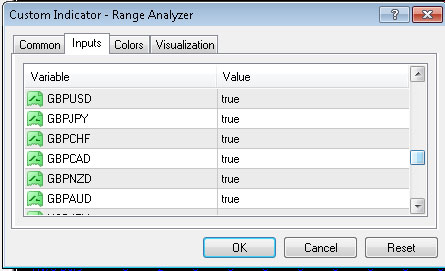

Selected pairs for ATR analysis

The multi-pair currency range analyzer is fully configurable and allows traders to create their own custom forex candidate pool for automated analysis.

Pair selection in the external parameters

Screenshots

Screenshot of the Range Analyzer showing CAD strength 11/01/11 c.08:20GMT. Note: CADJPY High Frequency count is noticeably higher than low frequency count indicating CADJPY is trending up (CAD strength). Low Frequency count on GBPCAD ,EURCAD & USDCAD is higher than corresponding high frequency count. Overall picture is CAD positive

Screenshot of GBPCAD chart displaying non discretionary entry and discretionary entry. Be aware that the analyzer indicates immediate strength based on the frequency differential between new highs/lows. You should not take the analyzer output in isolation as a trading signal. It should be used in conjunction with proper forex trade entry principles. The non-descretionary entry above was not well timed as the market subsequently retraced to retest the previous support level which then became resistance. A discretionary trade was placed at 1.54452 which went straight into profit. A discretionary approach will substantially reduce risk

Videos

Video Overview of the Range Analyzer

Range Analyzer Demo Video 2

Benefits

Using the multi-currency range analysis provides forex traders with the following trading advantages:-

Supporting Products

Pricing

One Time Fee with web based technical support